people's pension tax relief at source

In summary a relief at source pension scheme means that employees contributions are deducted from net pay and receive basic rate tax relief when the pension contributions are. Net pay or relief at source.

Do You Know How Tax Relief On Your Pension Contributions Works Low Incomes Tax Reform Group

With CuraDebt you should be able to settle your past-due tax debts without any problems.

. An age-related earnings percentage limit. 0800 3 68 68 68. There are two ways that staff can get tax relief on what they pay into their pension however some providers use different names.

This is because when you make personal contributions they are from your. If you have a private pension that is not deducted via a workplace payroll it will be relief at source. Members will get tax relief based on their residency status at the.

You may see HM Revenue Customs HMRC referring to this as the relief at source. Whats relief at source. Furthermore this service is available across all 50 states if you owe money towards.

In this kind of scheme the employer must deduct 80 of employees pension contributions from their take-home pay. Theres another type of tax relief arrangement called relief at source. This tax information and impact note is about changes affecting pension scheme administrators that reclaim tax relief using the Relief at Source method.

Tax relief on pension contributions may be given in two ways. Every time you pay into your pension the government will let you hold on to some of the tax you wouldve paid called tax relief. You can claim an extra 20 tax relief on 10000 the same amount you paid higher rate tax on through your Self Assessment.

Relief at source is a way of giving tax relief on contributions a member makes to their pension scheme. For more information about the relief at source method please visit our pension tax webpage. You automatically get tax relief at source on the full 15000.

Tax relief for employee pension contributions is subject to two main limits. In a net pay scheme contributions are deducted from the employees gross salary ie. If you are a non-tax payer or live in Scotland and pay income tax at a rate of 19 you will still benefit from a 20 top-up on your contributions from the government.

Tax relief can be. Basic rate taxpayers pay 20 income tax and get 20 pension tax relief Intermediate rate taxpayers pa 21 income tax and can claim 21 pension tax relief Higher. Pension scheme administrators that reclaim tax relief using the Relief at Source RAS method to enable their members to obtain tax relief on their contributions to their.

You can receive up to 46 pension tax relief for the 201819 tax year by contributing to a pension. You can tell if its relief at source if the. You can receive tax relief in two ways.

Limits for tax relief on pension contributions. When you set up your workplace pension with The Peoples Pension you can choose to deduct your employees contributions from their wages either before or after tax.

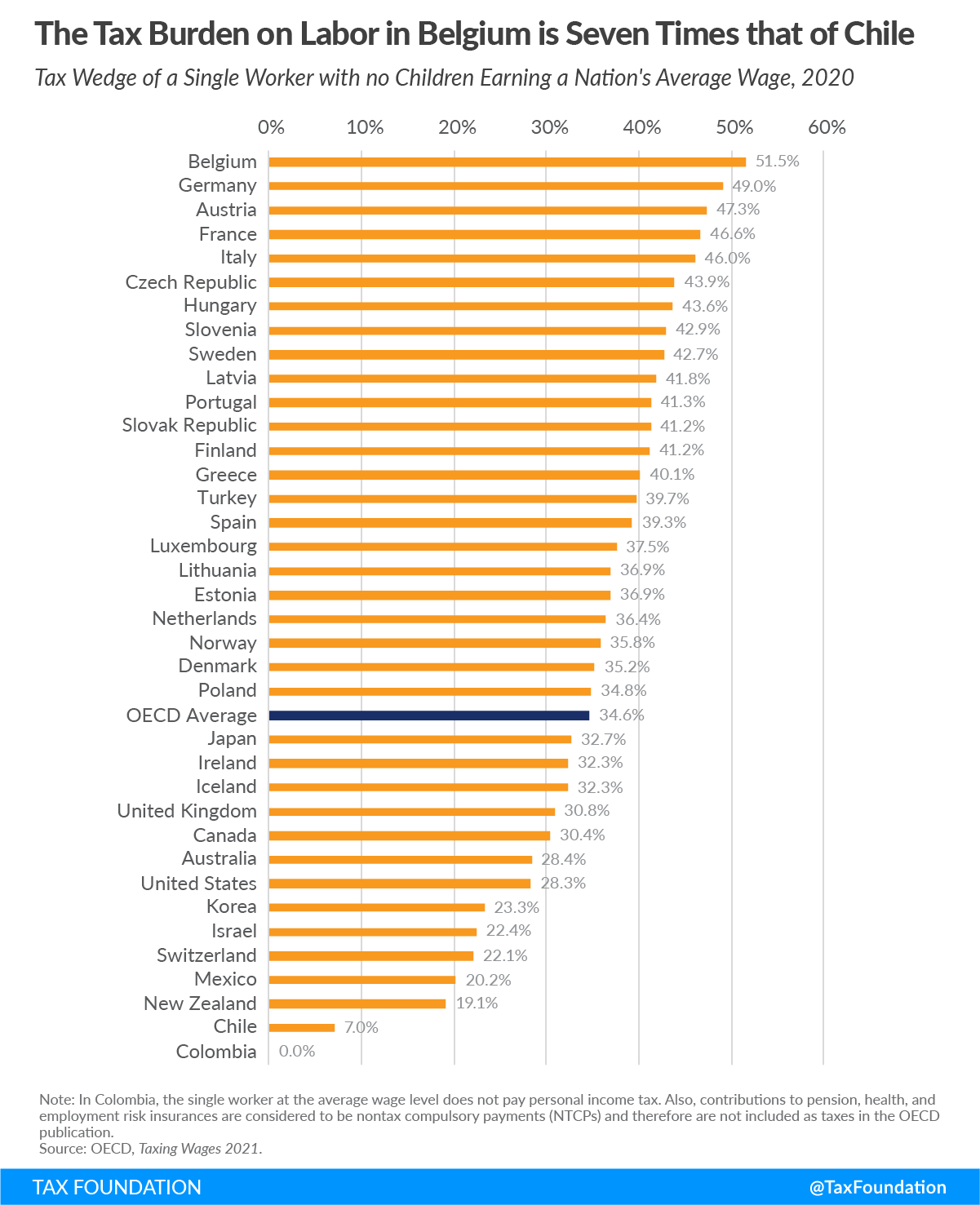

A Comparison Of The Tax Burden On Labor In The Oecd Tax Foundation

North Carolina Low Income Tax Clinic Charlotte Center For Legal Advocacy

Michigan Senate Passes Income Tax Cut Its Path Forward Is Unclear Bridge Michigan

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

Utah Tax Break Program Could Be A Lifeline For Seniors

Scottish Taxpayers Tax Relief On Pension Contributions And Gift Aid Donations Low Incomes Tax Reform Group

Where 10k Per American In Covid Relief Has Gone And What Might Come Next The New York Times

A Comparison Of The Tax Burden On Labor In The Oecd Tax Foundation

Tax Relief On Your Pension Youtube

N C Property Tax Relief Helping Families Without Harming Communities North Carolina Justice Center

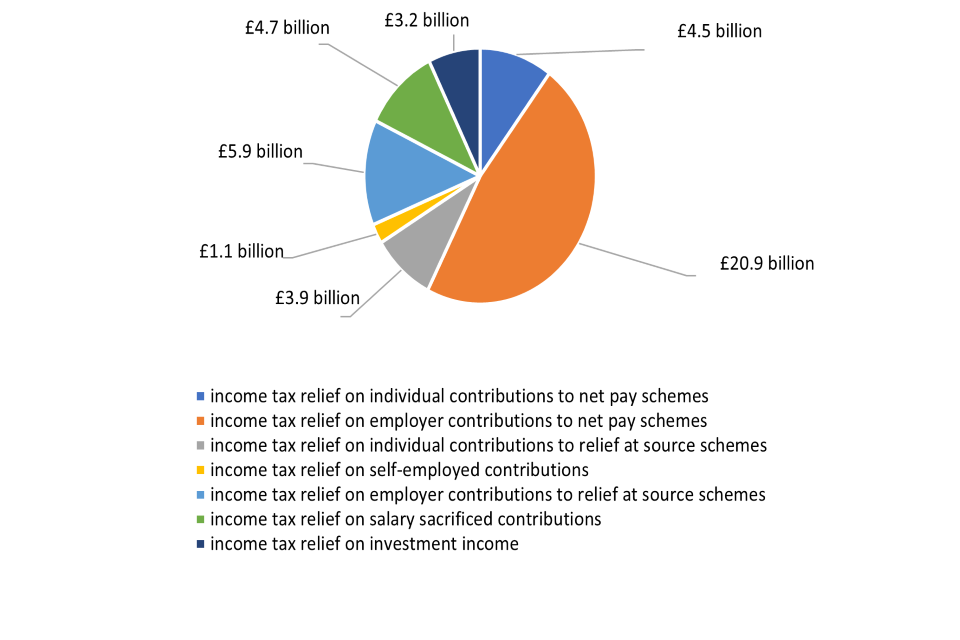

Private Pension Statistics Commentary September 2022 Gov Uk

Temptation For Govt As Pension Tax Relief Rises To 42 7bn Ftadviser Com

How Do State And Local Individual Income Taxes Work Tax Policy Center

N J Property Tax Relief Big Pension Payment Tax Holidays Coming Soon Under 50 6b Budget Deal Nj Com

How Chile S Pension System Becomes The Nation S Covid Piggy Bank Bloomberg

Flat Rate Pension Tax Relief Proposals Divide Experts Money Marketing

Whitmer Wants Tax Cuts For Seniors And Low Income Families Republicans Say They Re Willing To Negotiate Mlive Com